Top Fast Fashion Retail Companies in the Us

It'due south all too common these days to see strip malls plastered with "Everything must go!" signs announcing notwithstanding some other store closure. Over the concluding year, numerous brands have appear defalcation — some endmost their doors for good — while others promise for a chance at redemption through corporate restructuring.

The rise of e-commerce has left traditional retail companies struggling every bit the simplicity of the online shopping process woos customers away from brick-and-mortar stores. Hither's a look at some of the companies filing bankruptcy and shutting down.

Children'southward Clothing Retailer, Gymboree

Popular children's clothing retailer and owner of Crazy 8 and Janie and Jack brands, Gymboree, filed for Affiliate 11 bankruptcy on Jan. xvi and airtight all stores on April 22. Gymboree commencement filed for defalcation in 2017, closing well-nigh 400 stores and eliminating about $900 million in debt through a complete reorganization.

Unfortunately for the retailer, they were unable to recover, and market shares connected to plummet. In its most contempo filing, the company blamed its pass up on the "unanticipated degree of reject of the brick-and-mortar retail manufacture, amid other factors."

In a January. 17 argument, Gymboree Grouping CEO Shaz Kahng appear the "gut-wrenching" decision to shutter more than than 800 Gymboree, Gymboree Outlet and Crazy 8 stores in the US and Canada posted a letter to customers on the company'south website.

Since the announcement at the first of the year, Gymboree Group has sold all rights associated with the Gymboree and Crazy 8 brands to rival children'due south clothes retailer, Children'south Place, for $76 meg. Just what about their other brand, Janie and Jack?

What'southward the Fate of Gymboree-Endemic Boutique Brand, Janie and Jack?

The latest annunciation brings into question the security of the upscale, designer brand Janie and Jack, which currently operates 140 retail locations nationwide. Kahng, who is a long-fourth dimension Gymboree customer and mom herself, was able to shed some light on the futurity of Janie and Jack.

Kahng told stockholders that while the shuttering of Gymboree is "painful" news to share with the parents, grandparents and kids who have a deep emotional connection with the brand, the company remains "Focused on using this process to preserve Janie and Jack past pursuing a sale of the business, with the hope that it will continue to serve customers for years to come."

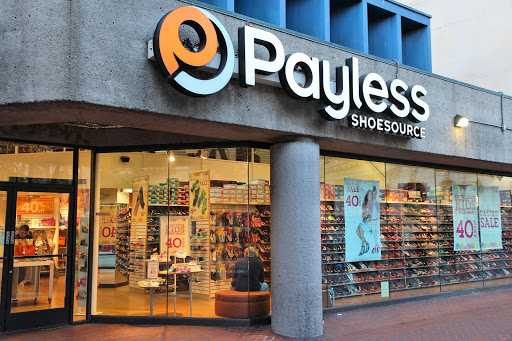

Value Shoe Giant, Payless ShoeSource

Bargain shoe retailer, Payless ShoeSource confirmed on Feb. 18 that information technology had filed bankruptcy and would be closing all 2,500 stores in the U.S. and Puerto Rico. Like many other companies hoping for a second chance later on filing bankruptcy, Payless filed for what has go known equally "Chapter 22" defalcation.

Chapter 22 defalcation is shorthand for a company'south second defalcation filing. The 63-yr-old visitor filed for its 2nd Chapter 11 defalcation protection less than two years afterward its first filing in April 2017. Following presently thereafter, they eliminated nearly 700 stores and about $435 million in debt.

What'south to Arraign for the Demise of Payless?

It can be difficult to understand what causes a well-known brand like Payless to shutter its doors. According to the company, "unanticipated" delays from their suppliers over the past two years forced the company to slash inventory prices.

Cutting inventory prices ultimately led to a significant loss – to the tune of most $63 million in 2018. Those factors are at to the lowest degree partially to blame for the latest bankruptcy filing, which also says Payless currently holds about $470 million in outstanding debt.

Shop Closings and Layoffs

So what's next for Payless? Individual store closings began in March and the final Payless store is expected to close past the stop of May. A picayune more than 16,000 employees of the discount shoe retailer will lose their jobs.

The liquidation of Payless stores beyond the U.Due south. will non affect the 420 franchised Payless stores in 20 other countries, primarily in Latin America and the U.South. Virgin Islands, which will remain open up (at least for the time being).

Denim Fashion Brand, Diesel

Diesel U.s. has always been known for its flashy advertising and quality denim products. Now, it'south also known equally a casualty of the recent consumer shift to online shopping. After a $90 1000000 capital investment vicious apartment, Diesel U.s.a. Inc. filed for defalcation on March v.

Deepening debt, poor management choices, expensive leases, a decrease in wholesale orders, mounting losses at its U.s.a. locations and multiple instances of theft and cyber fraud are all to blame. It's Italian parent company, Diesel S.p.A. is non part of the filing.

Furnishings From the 2008 Recession

Since its launch in 1995, Diesel fuel has been the exclusive distributor of Diesel fuel loftier-quality casual way products. Similar many other companies, they suffered a hit during the 2008 recession. Post-obit the recession, Diesel's sales were able to stabilize over again in 2011.

While the company seemed to be on the brink of recovery between 2011 and 2014, their sales began to plummet again afterward 2014. Strategic decisions made by upper management just oasis't been enough to grow the company further.

Can Diesel Brand a Improvement?

As of this writing, Diesel fuel has not appear which (if any) of its 28 brick-and-mortar stores volition exist endmost, and the visitor is hoping for a chance at revival. There are plans to open new stores, every bit well equally retrofit some existing stores, to become more than price-effective.

According to supplemental courtroom documents, Diesel fuel has "Revamped its management squad" and "formulated a new strategic path…to restore the Diesel brand in the United States." Through its "Reorganization Business Programme," Diesel hopes to remain open up in the U.S., endmost but "sure underperforming and plush stores" and preserving the jobs of its 380 employees while also creating new jobs.

Dwelling Effects Retailer, Z Gallerie

Apparel and accessory brands aren't the but companies hit hard by the e-commerce effect. Los Angeles-based company Z Gallerie filed Chapter 11 bankruptcy protection on March eleven, and announced plans to close 17 of its 76 home furnishings stores.

In the Chapter 11 filing, Z Gallerie reported $138 1000000 in outstanding debt and cited "missteps," including expansion that didn't meet expectations, the add-on of a costly distribution center and failure to invest in e-commerce equally reasons for the filing.

Bankruptcy Filing, Take Two

This is the second bankruptcy filing for the upscale furniture store, which was founded in 1979. Z Gallerie commencement filed for Chapter 11 protection in April 2009 after suffering a major sales slump. However, following that filing, they were able to somewhat recover.

The first bankruptcy filing resulted in the closing of 25 stores, merely Z Gallerie emerged from bankruptcy later on that year. Later the initial filing, the company was reduced to one distribution centre in Gardena, California, afterward closing its Atlanta location.

Will Corporate Restructuring Be Plenty to Relieve Z Gallerie?

Z Gallerie expects to receive $28 million in debtor-in-possession financing (which requires approval by the bankruptcy courtroom) from its existing lender to support operations during restructuring. "Z Gallerie has made pregnant progress on improving all facets of our operations, enhancing our customer services and scaling our E-commerce presence," said CEO Mark Weinsten.

During the Chapter 11 procedure, which is expected to final four months, brick-and-mortar stores and Z Gallerie's e-commerce operations will remain open. Z Gallerie has more than one,000 employees at 76 stores nationwide. "Hopes are high that the company volition emerge in one case over again, but it is dependent on a fast turnaround of the bankruptcy process for survival," says Weinsten.

Full general Merchandiser, Shopko Stores

On Jan. 16, Green Bay, Wisconsin-based Shopko Stores – a full general retailer of apparel, home, bed and bath, furniture, home electronics, etc. – announced it had filed for Chapter eleven bankruptcy. This wasn't altogether surprising to consumers, as big box stores have been hitting hardest past the shift to east-commerce.

The company, which cited debts between $1 billion and $10 billion, identified 100 stores for firsthand endmost with the initial filing, just held out hope of a sale. Unfortunately, Shopko could non reach a deal to salve its remaining retail locations and appear the closing of all 360 stores across 26 states by mid-June.

History of Shopko

Shopko was founded in 1962 past a chemist before beingness sold to private disinterestedness firm, Dominicus Capital letter Partners, in 2005. The visitor operates more than 360 stores in modest to mid-sized cities. Shopko'due south stores are located primarily in the Midwest, with a few locations on the West Coast.

In improver to its main Shopko stores, which provide proper noun-brand merchandise at a discount, the company operates in various other formats including: Shopko Express Rx, Shopko Pharmacy, Shopko Optical and Shopko Hometown. While most of these formats are on their way out, a few have been bought by other brands.

Is Anything Left to Save of Shopko?

Last Dec, the visitor sold pharmacy avails to competitors including Hy-Vee, CVS Pharmacy and Kroger. The sale sparked speculation Shopko might file for Chapter eleven and the visitor slowly confirmed individual store closures. Walgreens snatched up the remaining pharmacy assets in January.

In its Chapter xi statement, the company revealed plans to open up additional optical locations in 2019 after encouraging performances at its four freestanding optical centers. Following the final decision to close all Shopko locations, the 51 optical centers are existence re-evaluated. In January, the company appear it had secured financing from a group of lenders to keep its eyecare business concern running.

Full-Service Pilus Salon, Spa and Dazzler Retailer, Beauty Brands

Salon and spa superstore Beauty Brands declared defalcation on January. 6, citing nearly $7 meg in debt on a secured loan and an estimated $11 meg in liabilities to hundreds of creditors. This is Beauty Brands' beginning declaration of bankruptcy.

Beauty Brands was founded in 1995 by Bob Bernstein. In 2009, his son, David, replaced him as the president of the company. By 2014, the elder Bernstein sold nigh of his pale in Beauty Brands to a private equity grouping.

A Facelift for Beauty Brands

Facing stiff competition from beauty chains (like Ulta) and hoping to amend sales, Beauty Brands rolled out a new store concept in 2015. The new concept included a blowout bar where customers could get a quick launder and blow dry, likewise as a brow bar for eyebrow shaping and waxing.

Those efforts alone could non save the brand, and in December 2018, the visitor appear it would be closing 25 of its 58 stores, every bit well as reducing headquarters staff by ane-tertiary. The bankruptcy court approved the sale of 23 Beauty Brands stores to Bernstein, the original owner and Kansas City advertizement icon.

Is Dazzler Brands Improve Off in the Easily of Its Original Owner?

Bernstein is co-founder of Bernstein-Rein advert and is credited with inventing the McDonald'due south Happy Meal. His business organization entity, Absolute Beauty (the stalking equus caballus bidder for Beauty Brands) will assume the leases at 23 of the company'southward stores, including stores in Kansas City, St. Louis and select stores in Illinois, Iowa, Colorado and Texas.

Hilco Merchant Resources will liquidate the remaining stores. The Bernsteins hope to renew the cardinal values of the make, including a client-first approach and a culture that embraces a squad-building attitude.

"It's not but lip service – we really alive that," said Bob Bernstein.

Omnichannel Personalized Merchandiser, Things Remembered

Leading retailer of engraved gifts and keepsakes, Things Remembered, announced on Feb. 6 that information technology had filed for Chapter 11 bankruptcy, merely had already found a buyer. The company's sale to Enesco, a global leader in giftware and home decor and accessories, was approved by a judge and completed in March.

Over the years, Things Remembered, a 53-yr-old gifts retailer, has been recapitalized through the sale to various individual equity firms (the latest of which occurred in 2012). That investment relationship ended in 2017, due in part to the company's estimated $120 million in debt.

What Happens Now to Things Remembered?

Things Remembered operates more than than 400 locations nationally, and virtually 250 of those are expected to close equally the company attempts a reorganization. Under agreements of the auction to Enesco, online, direct mail and B2B retail operations of 176 stores will go on under the Things Remembered name.

The sale besides saves more than ane,400 jobs beyond Things Remembered stores, home office, fulfillment centre and e-commerce operations. In its filings, Things Remembered sought court approval for "a severance and outplacement program to support impacted employees," the visitor statement said. "Things Remembered employees…remain a critical part of the visitor'south futurity equally it moves through this process."

Teen Dress Retailer, Charlotte Russe

Charlotte Russe, the mall-based habiliment company, joined the ranks of companies filing defalcation, filing Chapter eleven on Feb. three. The company was founded in San Diego in 1975 and became a shopping mall mainstay popular among young women.

In 2009, it was acquired by a private disinterestedness group for $380 million. With $175 million in debt due in 2014 and loan principal growth of $lxxx one thousand thousand in the following years, sales could not go along up. This forced the company to file for bankruptcy protection, with hopes of a auction to a new owner through the process.

Can a Auction Save the Women's Clothing Retailer?

Initially, the goal was to close nearly 100 stores, use the bankruptcy bargain to get rid of some of its debt and find a heir-apparent who could go along it in business organization. When the auction deadline of Feb. 17 came and went without a heir-apparent, Charlotte Russe announced a liquidator had won the auction in bankruptcy court.

Its $160 1000000 in inventory would be liquidated and all of its 512 stores nationwide would close for practiced. At the time of the filing, Charlotte Russe had 8,700 employees with stores in every state (except Alaska). It likewise owned 10 stores selling Peek brand children'southward apparel, which it acquired. Unfortunately, well-nigh of the visitor's nearly 9,000 employees won't run into whatever severance pay, every bit it is rarely paid in U.s.a. bankruptcy cases.

Italian Luxury Fashion House, Roberto Cavalli

Only hours after the declaration that it was seeking a deal with creditors to preclude a bankruptcy filing, Roberto Cavalli airtight all of its North American shops. Famous for its flamboyant designs and fauna prints, the brand, headquartered in Florence, Italian republic, has seen sales struggle among the increasingly competitive global luxury market.

Roberto Cavalli filed for Chapter vii bankruptcy on April iv. At the time of store closures, the company'south The states CEO, Salvatore Tramuto resigned and its 93 United states employees were let go.

Tramuto addressed his resignation on Instagram, stating: "I now wish to focus on other projects that I put aside in order to reach our mutual goals with Roberto Cavalli Group."

A New Investment Deal

In March, prior to the store closures, the company announced it was seeking a new investment deal to prevent bankruptcy. No deal emerged, and the abrupt decision was fabricated to shut all US stores. "Due to severe liquidity constraints, the visitor is unable to pay its debts, including ordinary operating expenses, every bit they come due," courtroom documents stated.

In 2015, 90 percent of the make was sold to an Italian private disinterestedness house, while Roberto Cavalli himself retained the remaining 10 percent. A new CEO, Gian Giacomo Ferraris, was brought on to help with a relaunch. Four years ago, Cavalli stepped down from his design role, and the company has faced floundering sales and high turnaround always since, leading to its eventual bankruptcy, store closures and liquidation of its United states operations.

What'due south Unlike About Roberto Cavalli'due south Bankruptcy?

While the majority of companies filing for defalcation in 2019 have filed for Chapter 11 bankruptcy protection, Roberto Cavalli filed Affiliate 7 defalcation (also known equally liquidation defalcation). Under Chapter 7, the debtor's assets are completely sold off to pay creditors.

In Chapter 11 filings, the debtor is able to negotiate with creditors to alter loan terms with no mandate to liquidate assets. Many companies opt for Chapter eleven with the hopes of emerging from defalcation and either selling or restructuring in order to stay live.

Luxury Department Shop, Neiman Marcus

Bankruptcy may be on the horizon for privately held Neiman Marcus Group, which holds nearly $five billion in debt. CreditRiskMonitor warned that Neiman Marcus' take chances of going bankrupt in 2019 was as loftier as 50 percent. In add-on to its heavy debt load, central factors contributing to Neiman Marcus' risk of bankruptcy in 2019 include 5 sequent quarters of internet losses adding upwards to more than than $617 million and negative free cash flow.

Neiman Marcus received a FRISKⓇ score of "i" by CreditRiskMonitor – the proprietary FRISK score rates a company's level of fiscal distress on a scale of "1" (worst) to "10" (best). The written report is 96 percent authentic in predicting defalcation over a 12-month period.

What Tin Save Neiman Marcus?

In a Nov 2017 telephone call with analysts, sometime CEO Karen Katz noted that the retailer continues to "look at means to manage the balance sheet." Katz retired in February 2018, and was succeeded by Ralph Lauren executive, Geoffroy van Raemdonck. He and so inherited numerous challenges including a much needed sales increase – more merchandise to more customers.

According to a company press release, Raemdonck's appointment as CEO is part of Neiman Marcus' long-term leadership succession planning process to ensure growth and evolution of the visitor. Time will tell if Raemdonck will be able to mountain a turnaround and salvage the company.

Largest Usa Pet Retailer, PetSmart

Since it'southward 2017 buy of Chewy.com for $three.4 billion, the pet supply giant has struggled to pay downwardly its $8 billion in debt. Like most companies facing bankruptcy in 2019, growing competition from online retailers like Amazon, Target and Walmart has PetSmart in a tight spot. That is, at least when it comes to its more than than i,600 brick-and-mortar stores in the U.s.a., Canada and Puerto Rico.

PetSmart is one of almost 17 large-name United states bondage that are overloaded with debt and could go into default on loans or confront bankruptcy at some point this year. Macroaxis has recently pegged PetSmart's probability of bankruptcy at 38 pct.

Tin can the Chewy.com Acquisition Keep PetSmart Adrift?

Increasing competition from east-commerce could be the end of PetSmart if the purchase of Chewy.com isn't able to stem the company'due south losses. But first, PetSmart got caught up in a disputed transfer of Chewy.com assets. Lenders further claim that PetSmart was fraudulent in its motion of Chewy.com avails to a parent company and another unrestricted subsidiary.

In Apr, PetSmart passed a proposed loan amendment tightening restrictions on the company and limiting lenders' rights to pursue any further litigation in the dispute over Chewy.com assets.

If PetSmart can successfully shift focus back to maximizing its online sales and reducing debt, there may still be hope. But it seems the Chewy.com acquisition and subsequent legal battle may have weakened the pet production stores just enough that PetSmart's survival might be out of reach.

Lowe'due south: In Need of Some Repairs

Despite an uptick in earnings in the quaternary quarter of 2019, home comeback store Lowe's announced that it would still be endmost at to the lowest degree 34 "underperforming" locations in Canada. The company shuttered vi Lowe's locations besides equally two Reno-Depots and 26 Ronas.

Clearly, it'll have much more a hammer and some nails to repair Lowe's trajectory, but the company's president and CEO, Marvin R. Ellison, seems optimistic. "Although we nevertheless accept work to practise, I am confident we are on the right path," Ellison said. In Nov 2018, Lowe's closed a staggering 51 locations in the U.S. and Canada.

0 Response to "Top Fast Fashion Retail Companies in the Us"

Post a Comment